US Stock Market Today: Awaiting the Fed, Broadcom Report, & Tesla’s Rally

Market update: Tesla up 5.8%, Broadcom & Oracle earnings, plus anticipation of the Fed’s decision. Check out the full analysis on Gotrade.

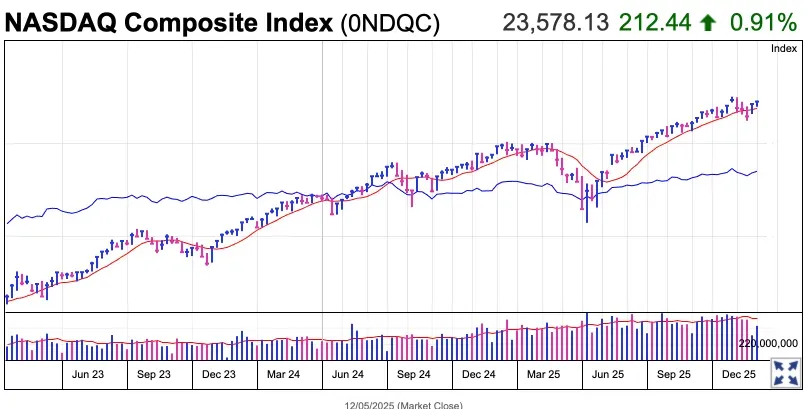

Jakarta, Gotrade News - The US stock market is currently in "wait and see" mode but is keeping its bullish trend alive. Investors are holding their breath ahead of the central bank's final meeting of the year, while waiting for financial reports from several big tech companies.

According to a report by Ed Carson at Investor’s Business Daily updated on December 7, 2025, major futures like Dow Jones, S&P 500, and Nasdaq showed thin movement on Sunday night. This reflects the market's cautious stance before facing a data-heavy week.

For those of you keeping an eye on your portfolio, here’s a recap of the key events you need to watch this week.

The Big Agenda: The Fed Meeting and the AI Ecosystem Test

The market's main focus is locked on the Federal Reserve (The Fed) meeting scheduled for this Wednesday. Market expectations are quite high that the central bank will cut interest rates again. A rate cut is usually good news for the stock market because borrowing costs become cheaper, which can spur business growth.

However, attention isn't just on the current rate decision. Investors are also looking forward to Jerome Powell's outlook on interest rates for 2026.

Beyond monetary policy, the tech sector—specifically Artificial Intelligence (AI)—is about to be tested again. Broadcom Inc. and Oracle Corporation are scheduled to release their earnings reports. The performance of these two companies is seen as an indicator of the overall health of the AI ecosystem. If the results are satisfying, this could be extra fuel for the tech sector rally.

Key Stock Movements: Tesla Strengthens and S&P 500 Rotation

Amid the macroeconomic anticipation, several individual stocks recorded significant moves. Tesla, Inc. managed to steal the spotlight with a 5.8% gain last week to the level of $454.94.

This rise was driven by positive sentiment after CEO Elon Musk stated that owners of the latest version of Full Self-Driving (FSD) can text while driving, even though this feature is still labeled as "supervised" and faces regulatory challenges in some states. Technically, the stock has moved above its 50-day moving average, a technical signal often regarded as an indication of a medium-term strengthening trend.

Meanwhile, there’s a shake-up in the prestigious S&P 500 index list. S&P Global announced the entry of Carvana Co. and Comfort Systems into the index. Getting into the S&P 500 is a huge deal because these stocks will automatically be bought by mutual funds and ETFs that track this index.

Conversely, there was disappointment for some investors. SoFi Technologies, Inc. and Vertiv did not make the S&P 500 addition list this time, causing their stocks to drop in trading last weekend.

In the banking sector, JPMorgan Chase & Co. also showed positive signals with a slight gain, bouncing off its 10-week support line. This shows that interest in the financial sector is still quite strong amidst economic optimism.

Media Merger Issues and Crypto Rebound

Beyond pure economic factors, politics are starting to influence market sentiment. President Donald Trump commented on the planned acquisition of Warner Bros. Discovery by Netflix, Inc.. Trump mentioned that the deal "could be a problem" due to potential monopoly or excessive market share. Comments from the president are often a signal for regulators to tighten anti-trust scrutiny.

In other asset classes, Bitcoin is showing its teeth again. The largest cryptocurrency bounced back to the $91,000 level on Sunday night after dipping to the $89,000 area. Crypto asset movements often go hand-in-hand with the risk appetite of tech stock investors.

Finally, the US 10-year Treasury yield rose 12 basis points to 4.14%. Yield is the return investors get from bonds. A rise in bond yields often puts pressure on the stock market because bonds become a more attractive, risk-free investment alternative compared to stocks. However, so far, the stock market seems to be absorbing this hike quite well.

Referensi:

- Investor's Business Daily, Dow Jones Futures: Tesla In Buy Area As AI Giants, Fed Loom. Accessed on December 8, 2025

- Featured Image: Shutterstock

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.