Gotrade Daily: Why Rate Cuts Matter for Wall Street

Stocks tumble as expectations for a December Fed cut fade sharply.

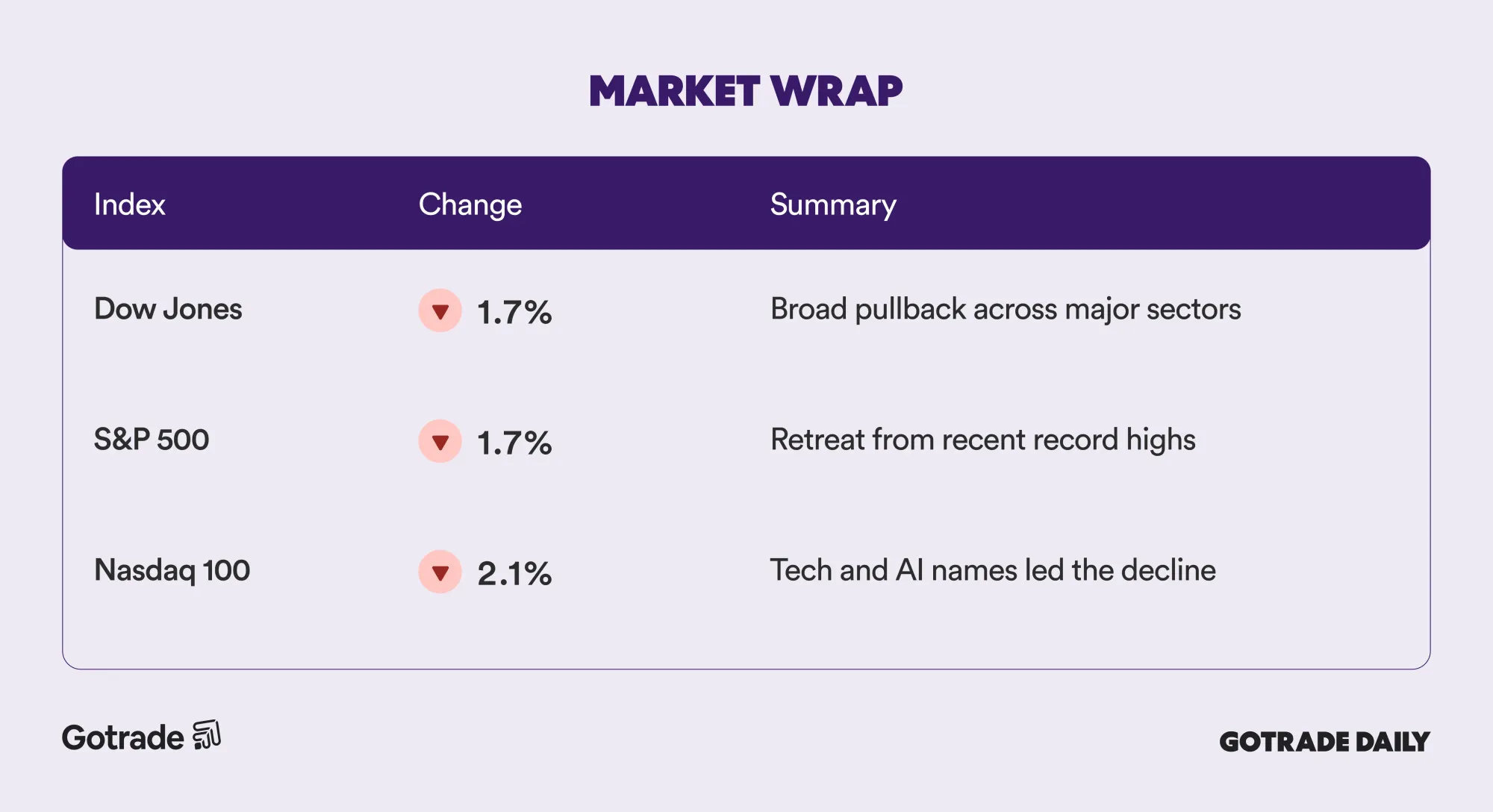

Wall Street slumped on Thursday as fading expectations for a December interest-rate cut triggered broad selling across U.S. markets. The S&P 500 dropped 1.6 percent, the Dow Jones fell 1.7 percent, and the Nasdaq 100 slid more than 2 percent as traders pulled back from stocks that rallied to recent record highs.

The shift came after CME FedWatch data showed the probability of a December rate cut falling to 50.7 percent, down from 95.5 percent on October 13. Traders are now split between a cut and a hold, marking a sharp reversal from the strong easing expectations seen over the past month.

The change hit high-valuation and growth names the hardest. Nvidia sank 4.7 percent, while Super Micro Computer, Palantir Technologies, and Broadcom each posted declines of more than 4 to 7 percent. Concerns that the Federal Reserve may pause its rate-cut cycle pressured stocks that depend heavily on lower borrowing costs and stronger earnings multiples.

Wall Street typically welcomes rate cuts because they can stimulate the economy, lift corporate profits, and increase the present value of future earnings. But a pause in December could undercut U.S. stock prices after they surged to records partly on expectations of further easing. With uncertainty rising around the Fed’s next move, investors remain cautious ahead of upcoming economic data and policy commentary.

📊 Market Wrap November 14th 2025

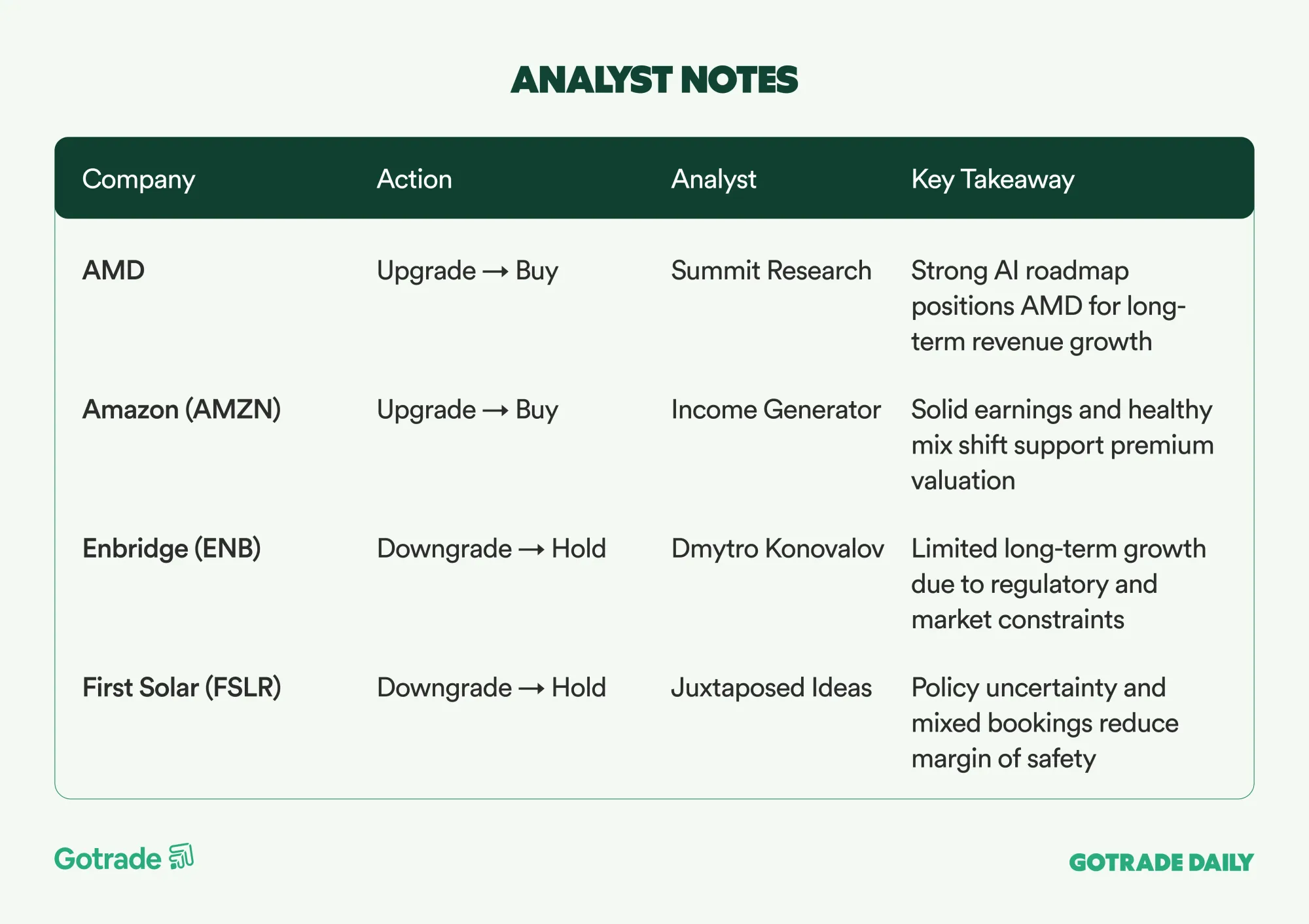

🧠 Analyst Notes

💬 Market Highlights

🚀 Virgin Galactic Targets 125 Spaceflights Per Year Starting 2026

Virgin Galactic (SPCE) aims to operate around 125 commercial spaceflights annually using its first two spacecraft once service begins in Q4 2026. The company projects roughly US$450 million in revenue and US$100 million in EBITDA per year based on its updated ticket price of ~US$600,000 per seat. For investors, SPCE remains an early-stage, highly speculative story, with outcomes heavily dependent on execution timelines and continued access to capital.

⚡ Plug Power Pauses DOE-Backed Hydrogen Projects, Putting US$1.66B at Risk

Plug Power (PLUG) has temporarily halted construction on six green hydrogen facilities previously supported by a US$1.66 billion Department of Energy loan guarantee. In a regulatory filing, management warned the funding could be revised or withdrawn as the company reevaluates capital allocation. While Plug shifts focus toward operational efficiency and more sustainable growth, the move adds significant near-term uncertainty to its outlook.

💾 Applied Materials Eyes 2026 Growth on AI Foundry and DRAM Demand

Applied Materials (AMAT) closed fiscal 2025 with record revenue of ~US$28.4 billion and gross margins nearing 49%, guiding 2026 as another growth year driven by strong demand in AI-related foundry logic and DRAM. Management expects wafer-fab equipment spending to ramp sharply in the second half of 2026, supported by AMAT’s strong positioning in advanced logic, packaging, and memory. With robust cash flows, aggressive buybacks, and rising dividends, AMAT is set to be a major beneficiary of the next AI capex cycle.

📅 Earnings Watch

With expectations for a December rate cut now split down the middle, the market is entering a more uncertain phase. Volatility could build as investors watch upcoming economic data and policy signals closely.

What stocks are traders watching as sentiment shifts?

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.