Gotrade Daily: Wall Street Rises on Shutdown Deal Hopes

Stocks gained as lawmakers moved closer to reopening the government.

Wall Street started the week on a hopeful note as optimism grew that lawmakers in Washington are nearing a deal to end the historic 41-day government shutdown.

The progress lifted investor confidence and brought a wave of relief to the markets after weeks of uncertainty.

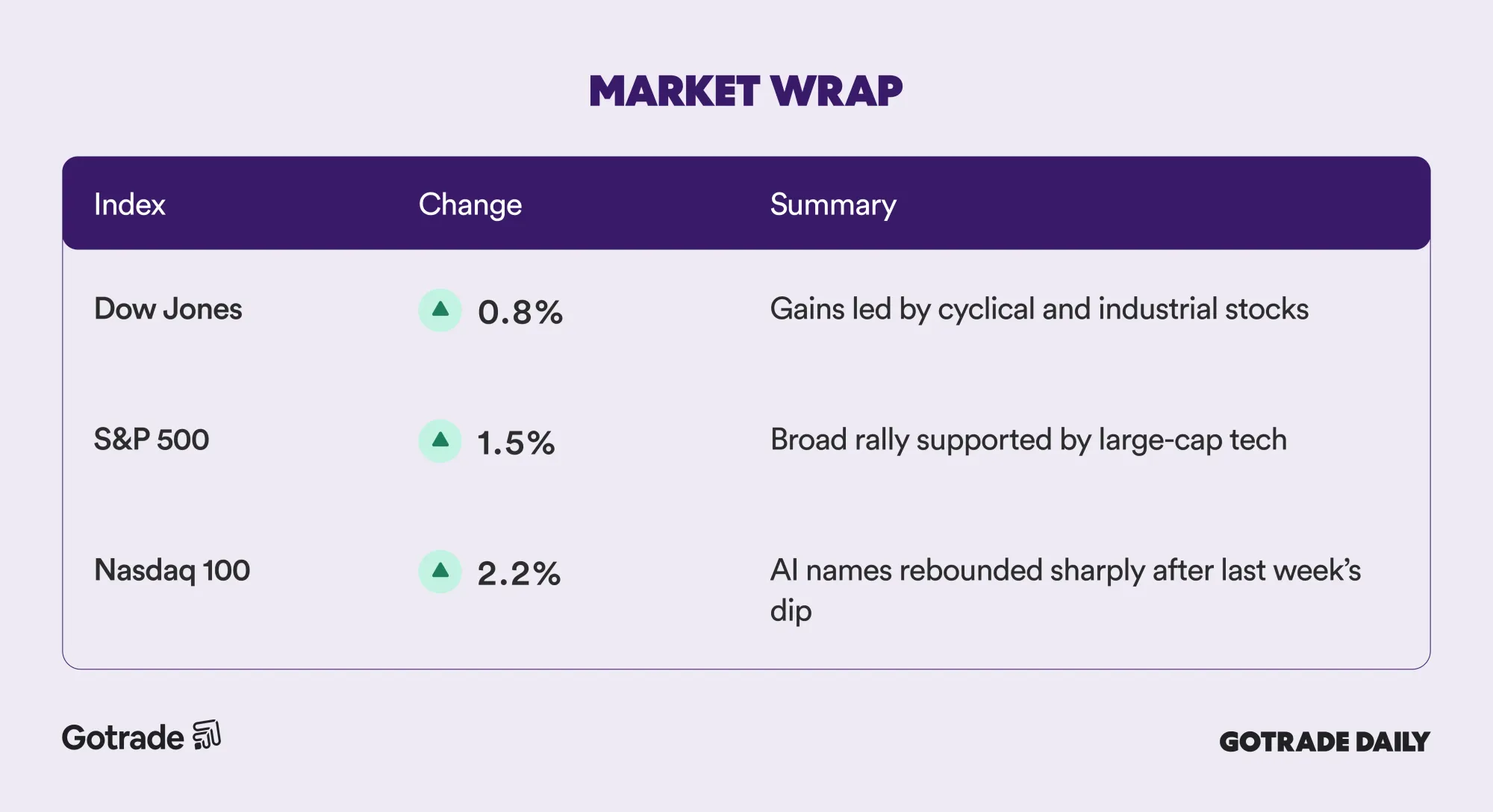

The Dow rose 0.8%, the S&P 500 gained 1.5%, and the Nasdaq jumped 2.2% as AI leaders like Nvidia, Broadcom, and Microsoft helped fuel a broad rebound.

Investors welcomed reports that the agreement could reopen the government through January, restore federal operations, and allow key economic data releases to resume.

For many traders, this shift marks a turning point, a moment to refocus on fundamentals and look ahead to the final stretch of the year.

Market Wrap November 11th 2025

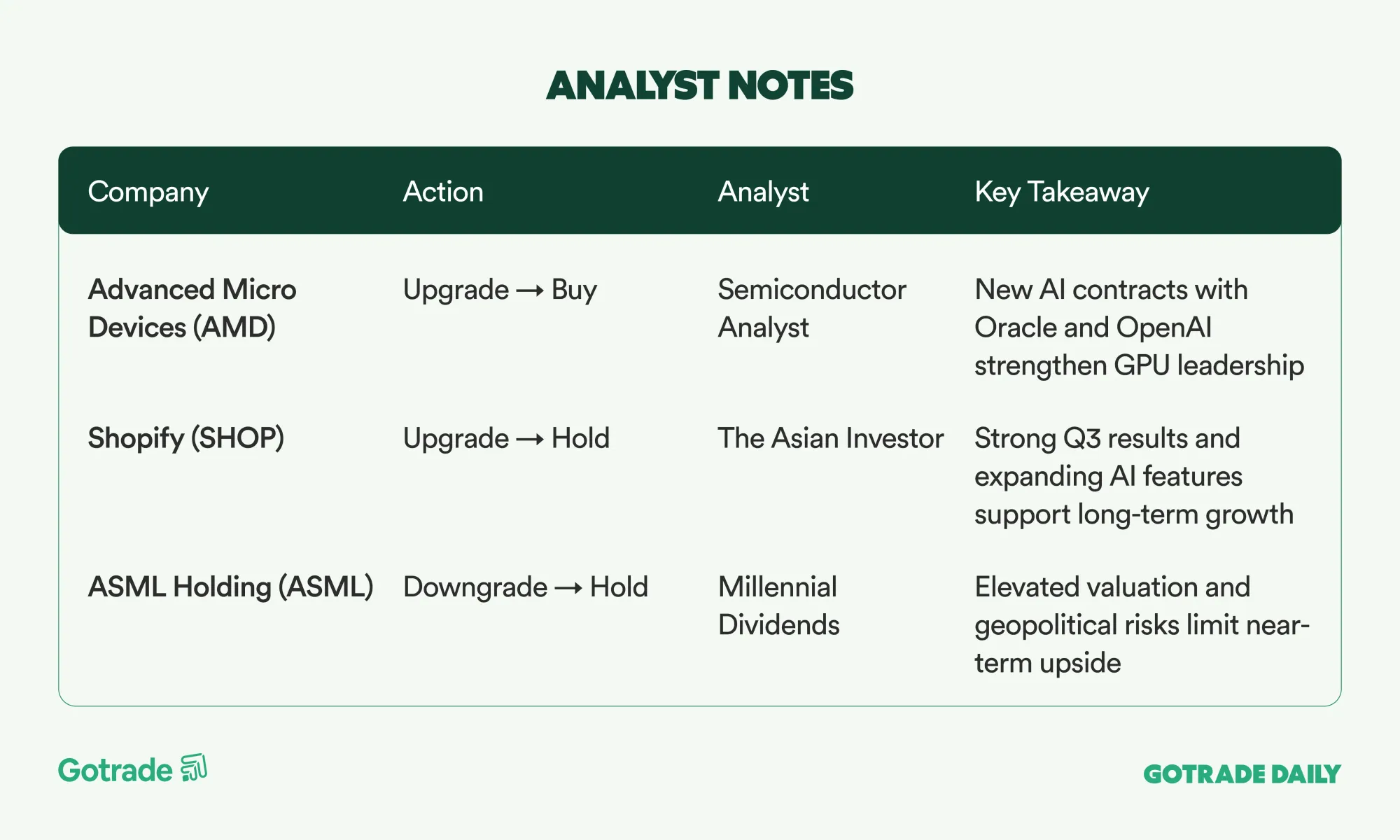

Analyst Notes

Market Highlights

Tesla Gains Investor Support for Its AI and Robotics Ambitions

Tesla (TSLA) received strong shareholder approval at its annual meeting, reaffirming Elon Musk’s compensation plan and long-term strategy.

Chair Robyn Denholm called it a sign of confidence in Tesla’s Robotaxi and Optimus projects, seen as the next phase of growth beyond electric vehicles.

Beyond Meat Extends Losses, Focuses on Turnaround and Cost Efficiency

Beyond Meat (BYND) reported Q3 revenue down 13.3% year over year to US$70.2 million, driven by a 10.3% decline in volume and softer demand across U.S. and international markets.

Gross margin fell to 10.3% from 17.7%, while EBITDA loss widened to US$21.6 million. CEO Ethan Brown said the company is focusing on improving its balance sheet through bond exchanges, debt extensions, and cost-cutting measures. Analysts remain cautious after Q4 sales guidance came in below expectations, with shares falling 9% after hours.

Warren Buffett Converts Class A Shares to B for Charitable Giving

Berkshire Hathaway (BRK.B) CEO Warren Buffett converted 1,800 Class A shares into 2.7 million Class B shares for donation to four family foundations, including the Susan Thompson Buffett Foundation.

The move comes as Buffett prepares to step back from annual reports and public appearances, marking the closing chapter of his leadership. Analysts see it as both a liquidity boost for the recipients and a signal of Berkshire’s next generation of stewardship.

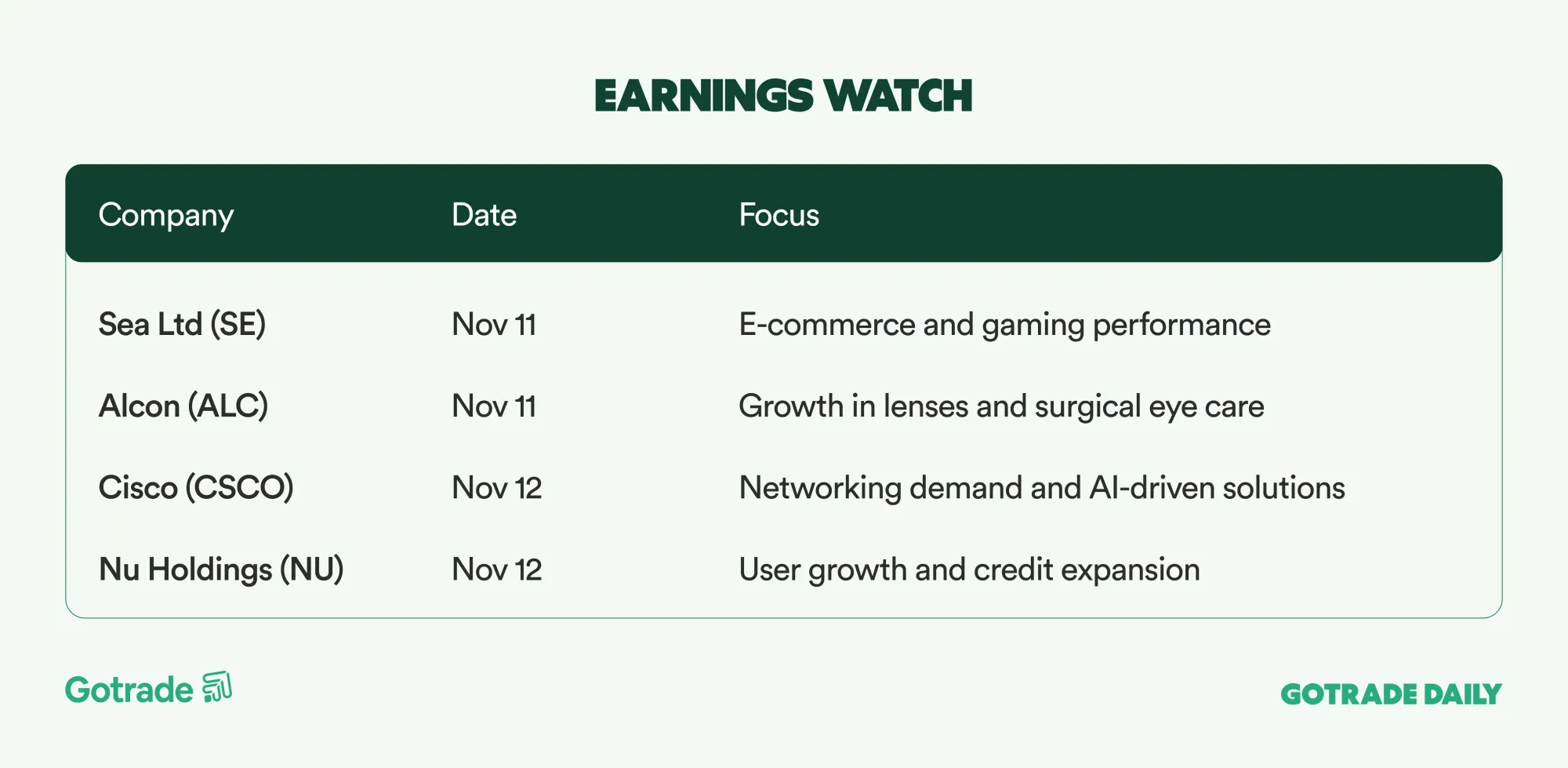

Earning Watch

The week begins with optimism returning to Wall Street.

As lawmakers move closer to ending the shutdown and key sectors regain momentum, traders are starting to look beyond short-term noise and refocus on what’s next.

Which stocks do you think will lead the next move?

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.