Gotrade Daily: S&P 500 Hits Fresh Records as Tech Leads

AI leaders drive gains as rate cut bets hold firm.

US stocks extended gains for a fourth straight session on Tuesday, with technology shares pushing the S&P 500 to a new record close during a holiday-shortened week.

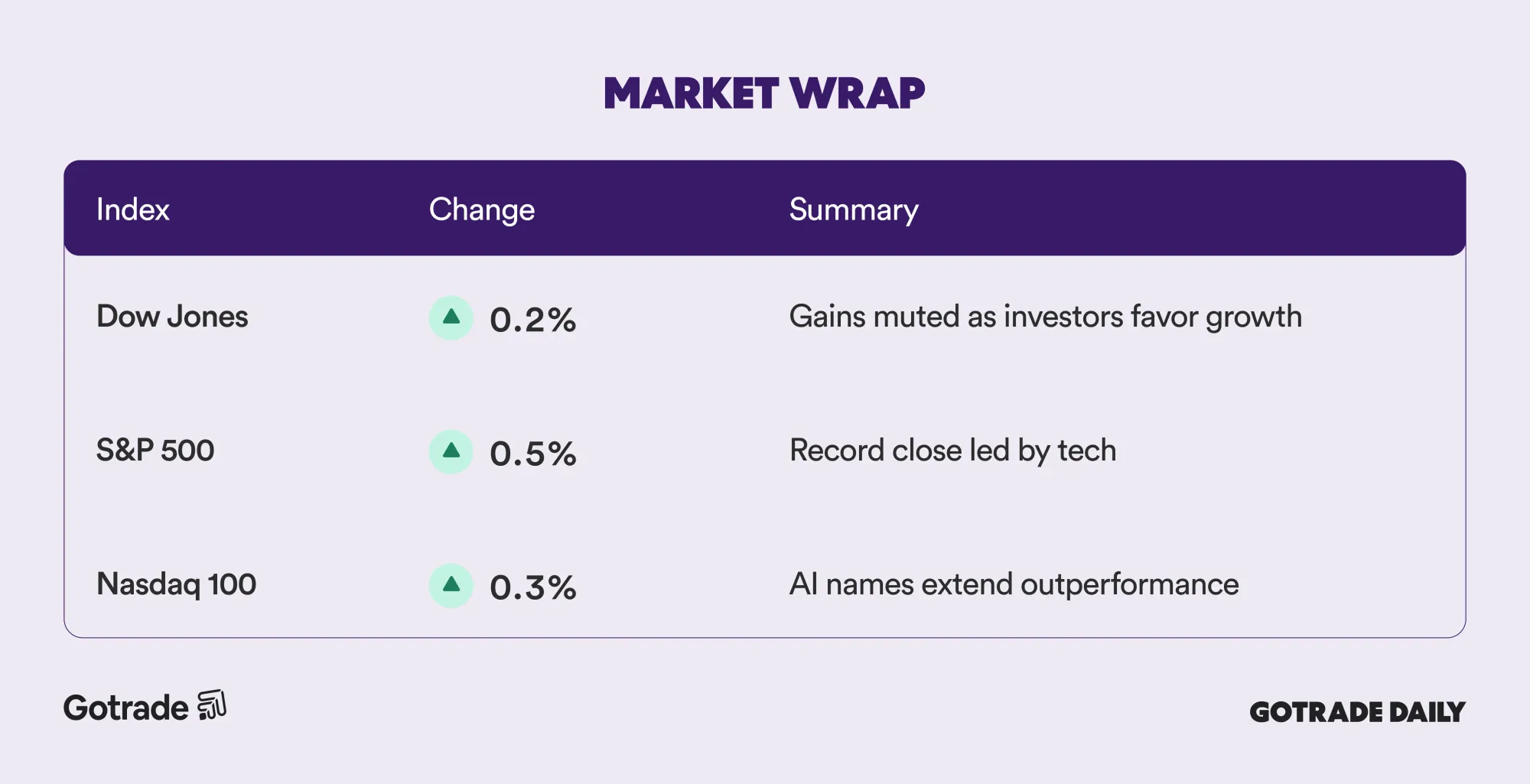

The S&P 500 rose 0.46% to 6,909.79, marking its highest-ever close. The Nasdaq Composite added 0.57%, while the Dow Jones Industrial Average edged up 0.16%. Momentum remained concentrated in growth and AI-linked names.

Leadership came from mega-cap tech, with Nvidia (NVDA) climbing around 3% and Broadcom (AVGO) gaining more than 2%, reinforcing the market’s preference for AI exposure into year-end. The advance extended last week’s rebound as investors leaned back into technology despite lighter volumes.

Stronger-than-expected economic data failed to derail sentiment. Revised figures showed US GDP grew at a 4.3% annualized pace in Q3, well above expectations. While the report briefly weighed on stocks early in the session, markets stabilized as traders continued to look past near-term strength toward easing policy next year.

Rate expectations remain supportive. Futures markets are still pricing two Federal Reserve rate cuts by the end of 2026, according to CME data, even as growth data stays firm. With attention shifting to potential changes in Fed leadership, investors appear comfortable maintaining risk exposure.

US markets will close early on Wednesday for Christmas Eve and remain shut on Thursday for Christmas Day, keeping liquidity thin through the rest of the week.

📊 Market Wrap Dec 24th 2025

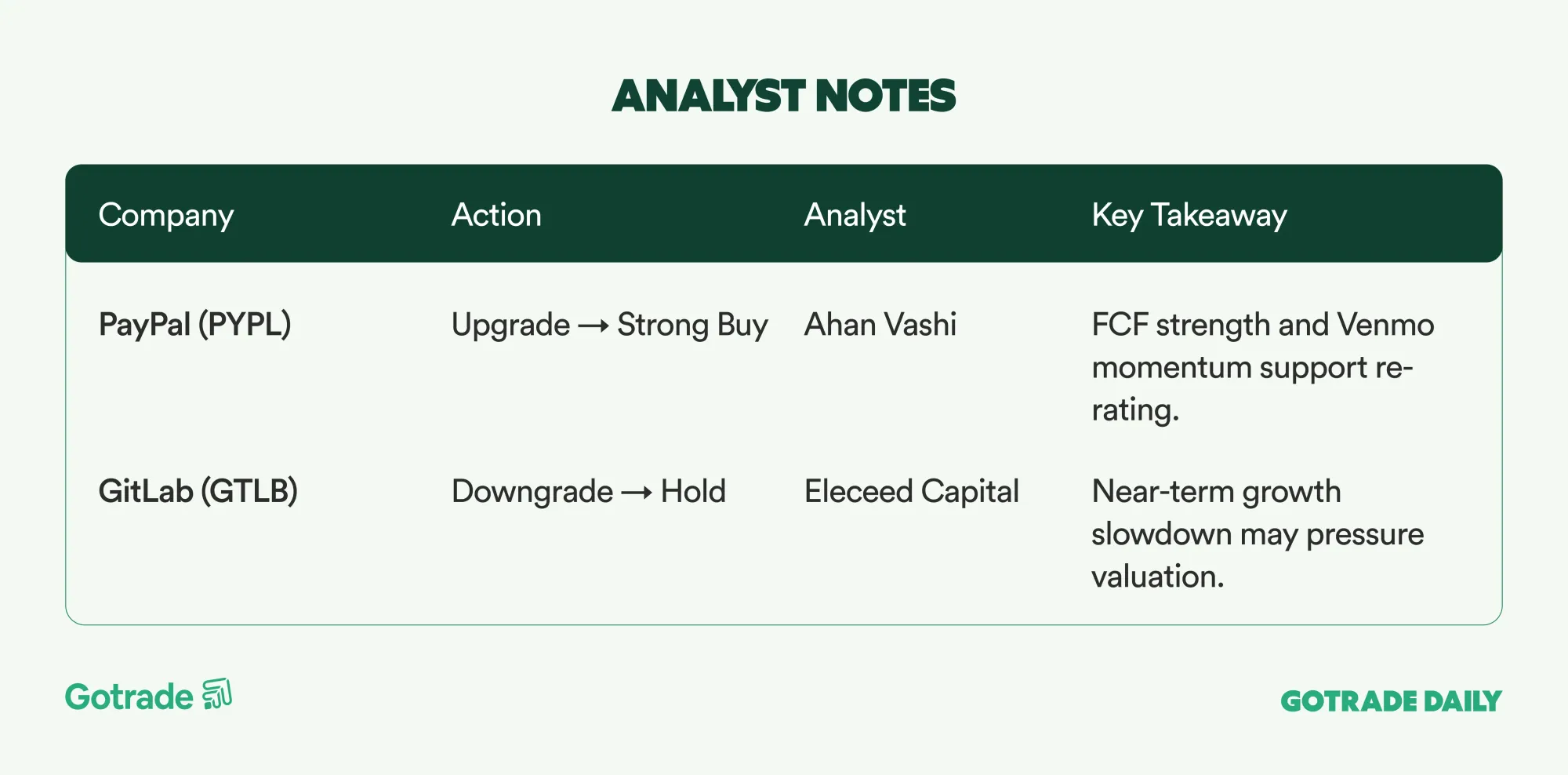

🧠 Analyst Notes

💬 Market Highlights

Marvell in focus ahead of CES, Citi adds catalyst watch

Marvell (MRVL) drew attention after Citi added a 30-day catalyst watch ahead of next month’s CES. Shares rose about 3.4 percent, as the firm said concerns around XPU competition and optical or DSP opportunities appear overstated. Citi views the post-earnings pullback as a buying opportunity, especially if CES highlights stronger adoption of scale-up networking and CPO that could support medium-term revenue growth.

iPhone 17 lead times continue to ease

JP Morgan notes that lead times for Apple’s iPhone 17 (AAPL) are shortening across the US, China, and Europe. The improving supply-demand balance points to fewer production bottlenecks and lower execution risk. This trend supports stable iPhone unit volumes and revenue momentum through the remainder of the product cycle.

Costco heads into 2026 with steady operating momentum

Costco (COST) exits 2025 with resilient sales growth, supported by recurring membership income and solid e-commerce execution. Its strong balance sheet and free cash flow profile keep the possibility of a special dividend or stock split in focus for 2026. At the same time, valuation remains a key consideration after the stock’s defensive performance.

📅 Earnings Watch

No major earnings releases this week.

US equities head into the final stretch of 2025 with momentum intact, led by technology and AI-related names. Thin liquidity may amplify moves, but leadership trends and rate expectations continue to set the tone.

Which stocks are you watching today?

Note: U.S. stock markets are closed on December 25 for the Christmas holiday, so Gotrade Daily will not be published that day.

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.