Gotrade Daily: Optimism Builds as Senate Nears Shutdown Deal

After a volatile week dominated by the 39-day U.S. government shutdown, optimism is starting to return. Lawmakers in the Senate are reportedly close to a deal to reopen the government and reverse recent federal layoffs, helping lift sentiment ahead of the new week.

The potential agreement, expected to fund operations through January, would include protections for government workers and restore delayed federal spending.

Stock futures moved higher in early trading as investors welcomed signs of progress, with the Nasdaq up 1%, S&P 500 futures rising 0.6%, and Dow futures adding 79 points.

Why Ending the Shutdown Matters?

The shutdown has halted key economic reports such as inflation and employment data, making it difficult for investors to assess the strength of the U.S. economy or predict the Federal Reserve’s next steps. It has also pushed consumer sentiment to its lowest level in more than three years.

A deal in Washington could restore transparency and reduce uncertainty, allowing traders to refocus on fundamentals like earnings, spending, and growth. Reopening government operations could also benefit sectors linked to public infrastructure, logistics, and defense.

If passed, the deal could help restore confidence by bringing back clearer data and policy visibility, giving markets a steadier foundation after weeks of speculation.

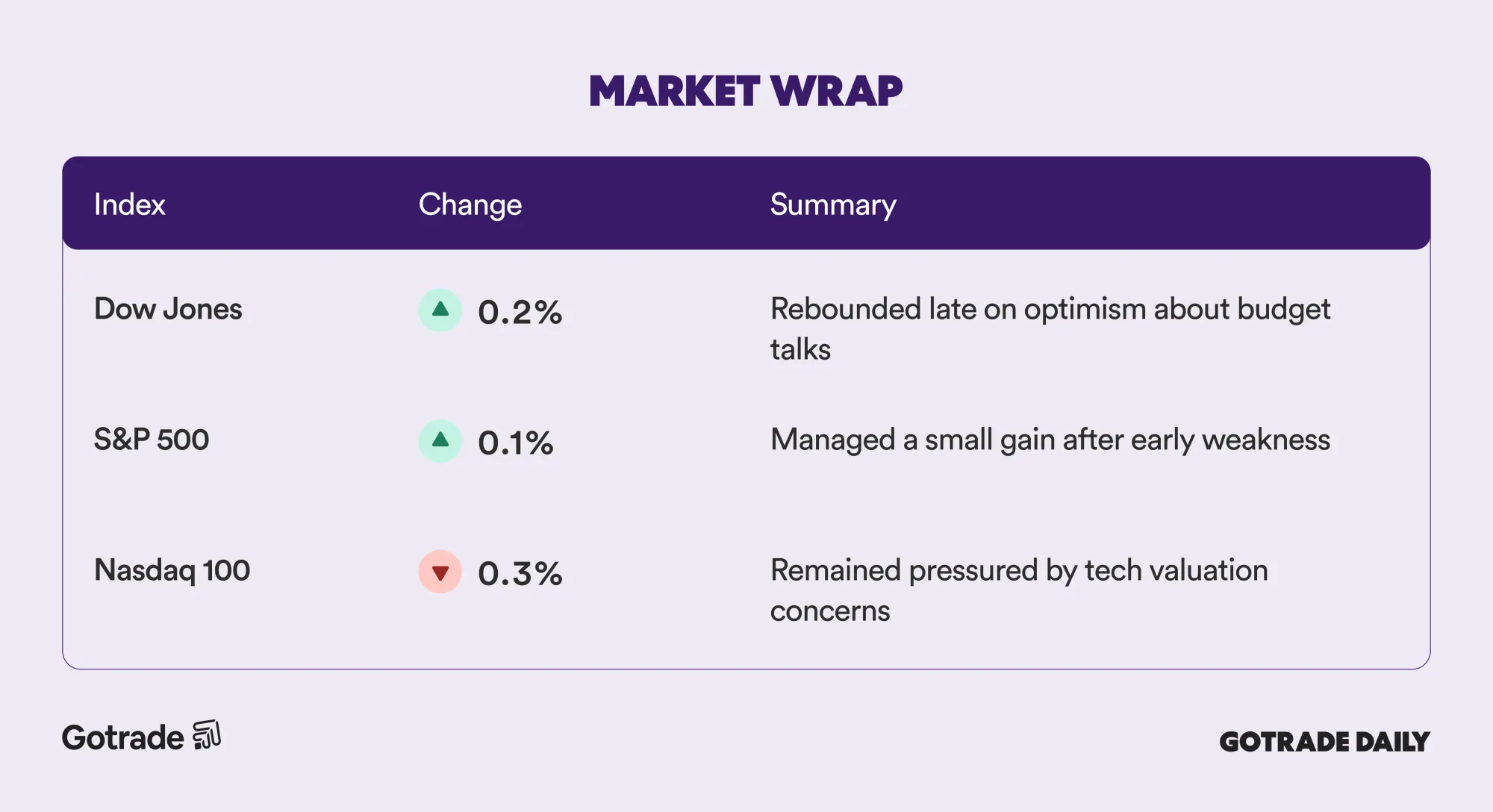

Market Wrap November 10th 2025

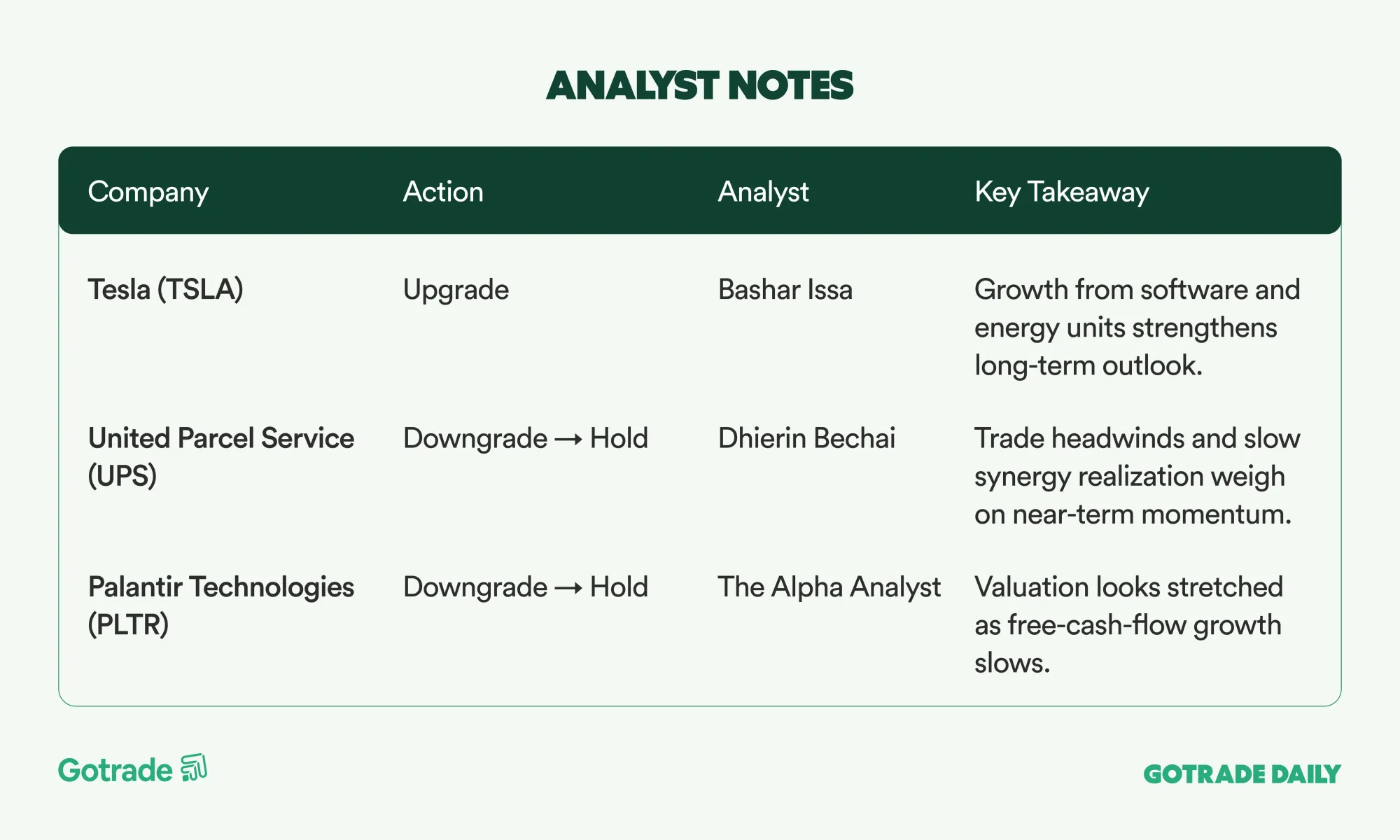

Analyst Notes

Market Highlights

Visa and Mastercard Near Settlement in 20-Year Fee Dispute

Visa (V) and Mastercard (MA) are reportedly close to resolving a two-decade legal battle with U.S. merchants over interchange fees.

The deal, which still requires court approval, would trim transaction fees by roughly 0.1 percentage point over several years and allow merchants to decline premium cards with higher costs.

Investors see the potential settlement as a meaningful de-risking event. While it would slightly reduce revenue from high-fee transactions, it could also remove a major source of litigation uncertainty and strengthen both companies’ long-term outlooks.

Boeing Invests US$1 Billion to Expand Dreamliner Production

Boeing (BA) announced a US$1 billion investment to expand its 787 Dreamliner plant in South Carolina, aiming to double production by 2028. The move comes amid a global surge in demand for long-haul aircraft and will add 1,000 new jobs over five years.

Analysts view the expansion as a vote of confidence in Boeing’s widebody strategy. While the company still faces supply-chain challenges, the added capacity could help it capitalize on a strong order backlog and accelerate post-pandemic recovery.

FAA Cuts 10% of Flight Capacity; UPS and FedEx Retire MD-11 Fleet

The U.S. Federal Aviation Administration ordered airlines to reduce peak-hour domestic flights by 10% across 40 major airports, coinciding with UPS (UPS) and FedEx (FDX) retiring their aging MD-11 cargo jets after a fatal incident in Louisville.

The combined effect could temporarily tighten air logistics ahead of the holiday shipping season. However, both carriers have emphasized flexibility in rerouting packages through ground networks and secondary air hubs, helping mitigate disruptions and maintain service levels.

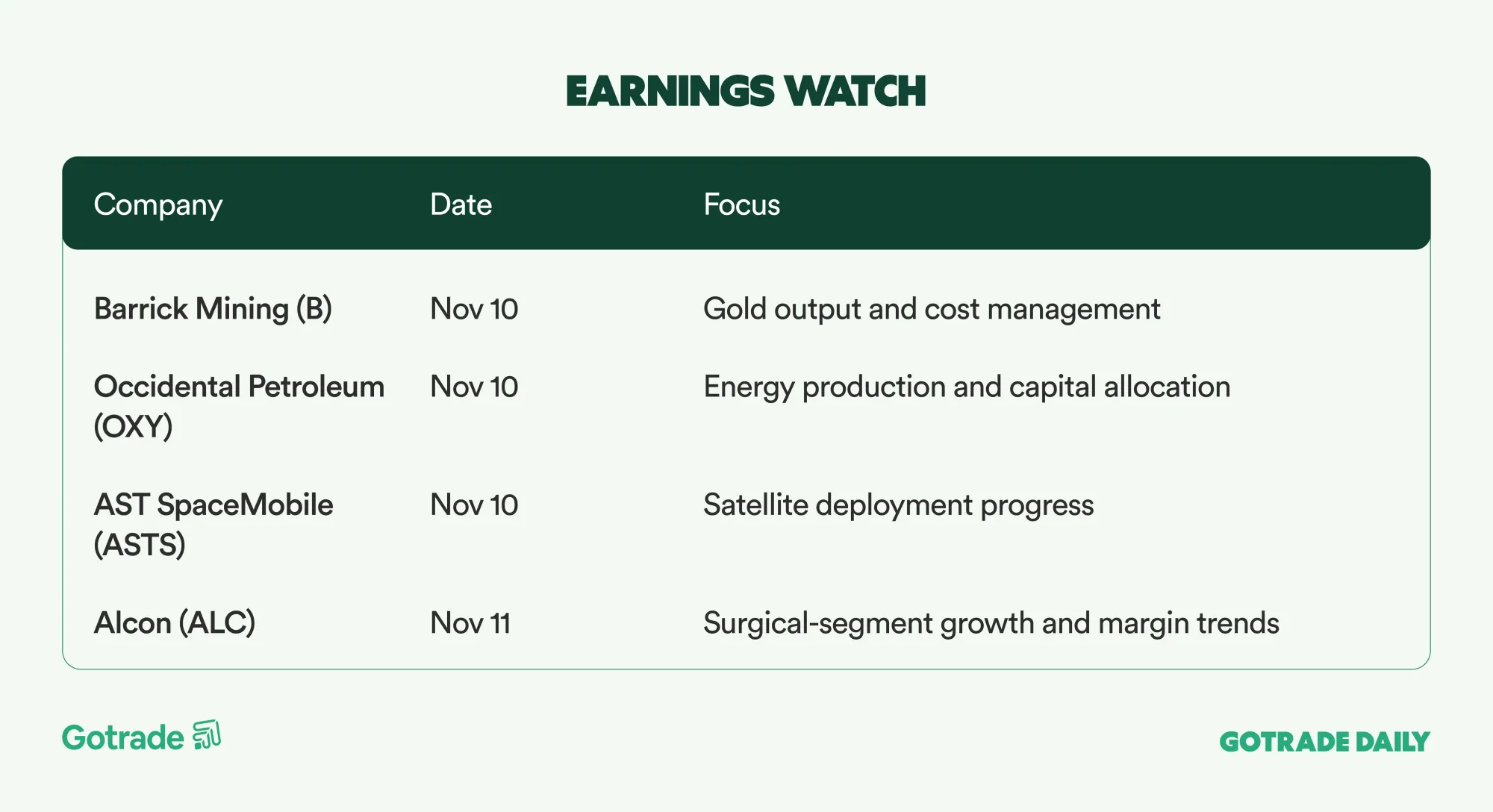

Earnings Watch

Markets are ending the week on cautious optimism as Washington nears a deal to end the historic shutdown. With optimism building around a possible resolution, traders are watching how sentiment shifts once Congress takes its next step.

Curious which stocks are reacting first?

👉 See what traders are watching today

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.