Gotrade Daily: Financials Power the Dow to a New Record High

Strength in banks and other major sectors helped the Dow notch a fresh all-time high.

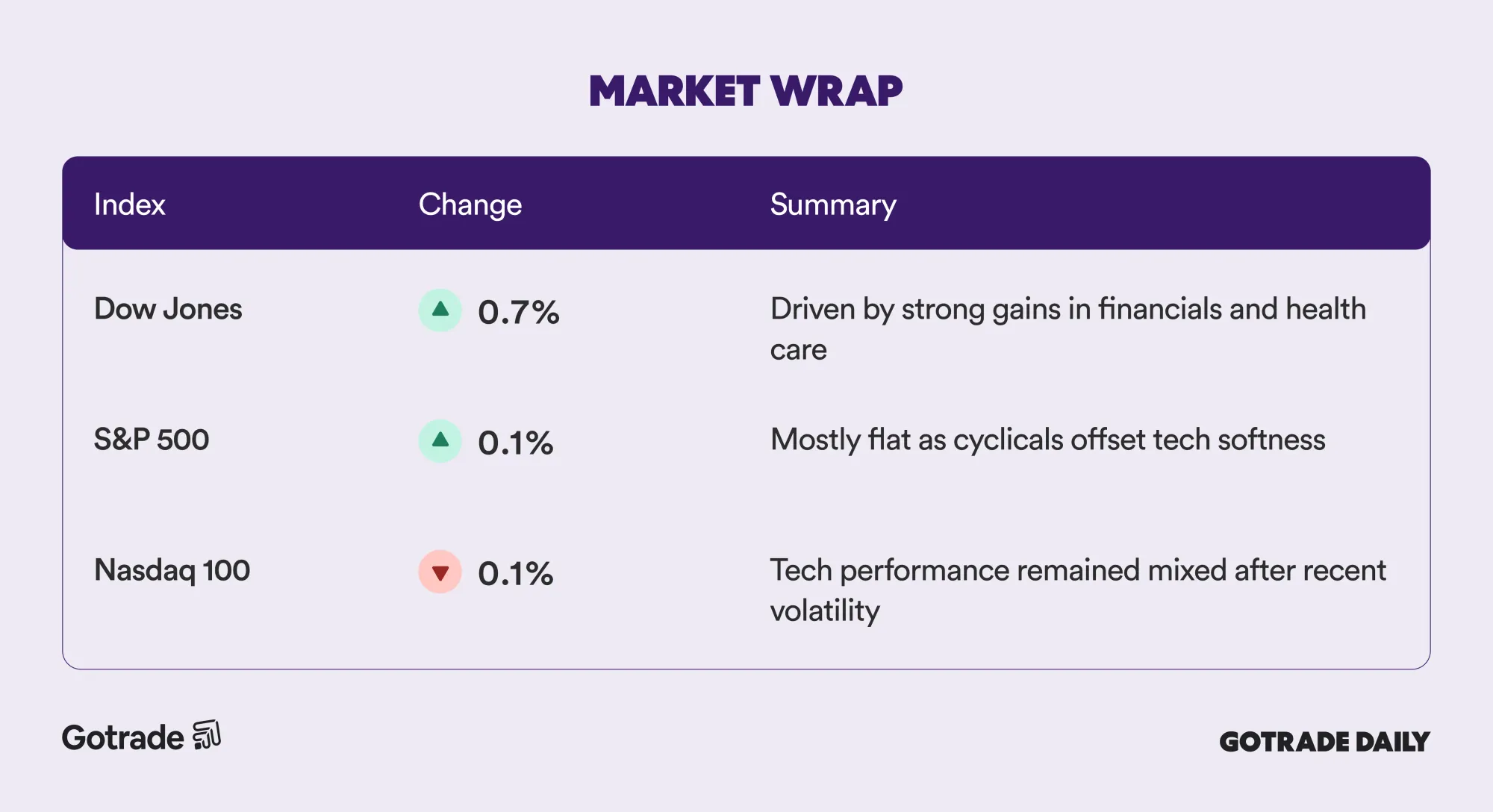

Wall Street pushed higher on Wednesday as financials and health care led the gains, powering the Dow Jones to a new record close above 48,000. The move came as investors expected Washington to end the 43-day government shutdown. Soon after, lawmakers approved the bill that officially ended the shutdown.

The momentum came as the House prepared for a final vote on a funding bill that could reopen the government as early as this week. A resolution would unlock the release of unemployment, inflation, and other key economic reports that investors and the Federal Reserve have been missing for more than six weeks.

The broader market delivered a mixed session. The S&P 500 held steady near recent highs, while the Nasdaq dipped slightly as performance across tech remained uneven. AI-linked stocks posted both gains and pullbacks, continuing a month of volatility driven by valuation concerns.

Treasuries rallied as yields slipped, helped by growing expectations that the Fed may have room to cut rates in December once official data resumes. Oil prices declined on renewed supply concerns, while the dollar traded in a narrow range.

Despite limited economic visibility during the shutdown, analysts noted that equities have remained resilient. Historically, markets tend to rise in the month following a government reopening, and strategists expect data clarity to be a key driver in the weeks ahead.

📊 Market Wrap November 13th 2025

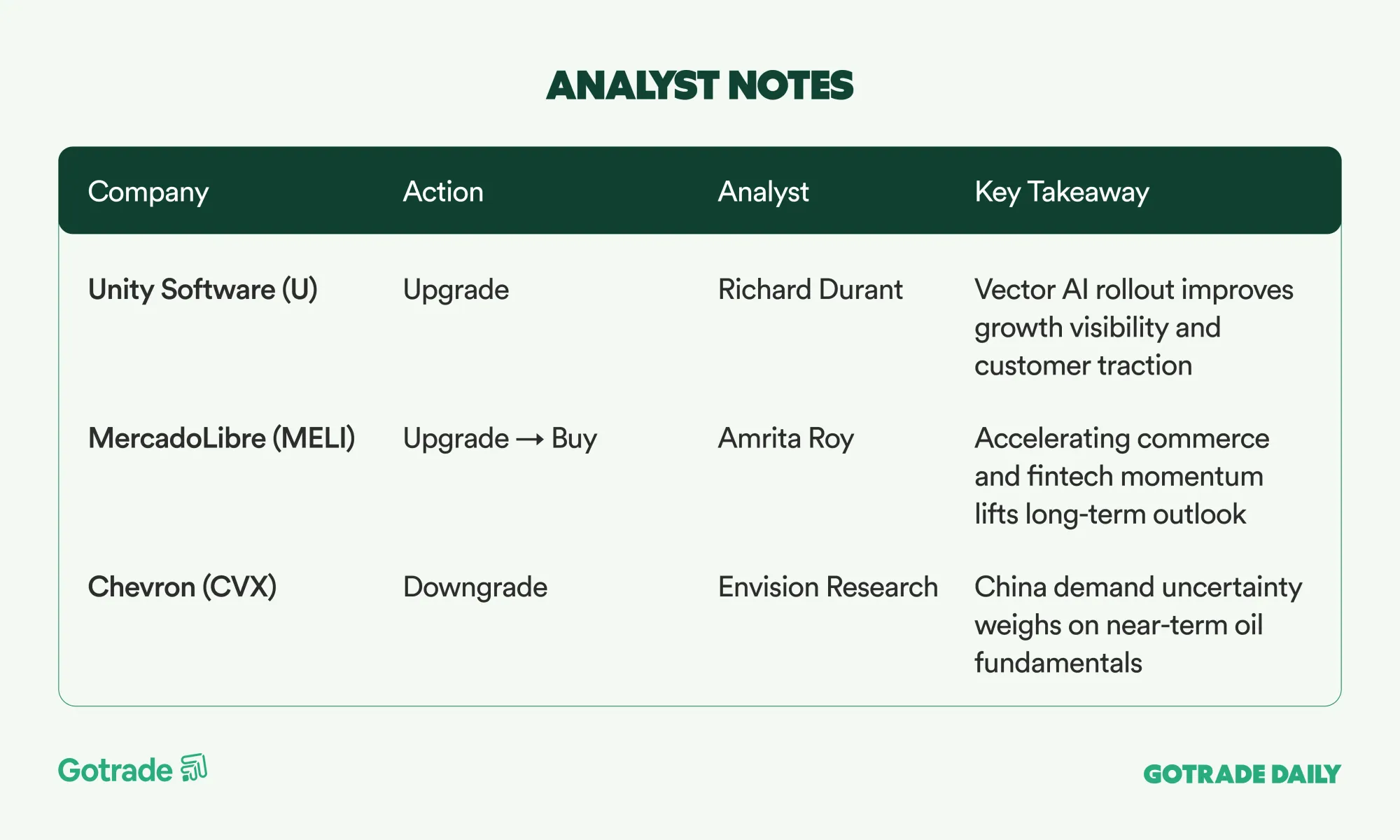

🧠 Analyst Notes

💬 Market Highlights

💻 AMD Seen Reaching EPS of $20 as AI Data Center Demand Accelerates

BNP Paribas said AMD (AMD) could reach EPS of $20 within 3 to 5 years, supported by rapid growth in the AI data center market, which AMD now estimates could reach $1 trillion by 2030. Rising demand for CPUs, GPUs, HBM memory, and rack-scale systems is expected to lift revenue growth and expand margins. Analysts noted further long-term upside if AMD maintains its current momentum. Shares rose nearly 9 percent after the updated outlook.

🏗️ Meta Builds $1 Billion AI Data Center in Wisconsin

Meta Platforms (META) announced plans to build a $1 billion AI data center in Beaver Dam, Wisconsin, supported by a separate $200 million energy infrastructure investment with Alliant Energy. The facility will use dry-cooling technology to reduce water and energy consumption. It will be Meta’s 30th global data center and supports its multi-year capex plan to expand AI capacity across its platforms.

🌐 Cisco Targets $3 Billion in AI Infrastructure Revenue by FY26

Cisco (CSCO) said it is targeting around $3 billion in AI infrastructure revenue from hyperscalers by FY26. The company posted record Q1 earnings supported by strong demand for networking and AI-driven systems. Management also raised its FY26 revenue and EPS guidance, supported by a multi-year campus networking upgrade cycle. While security and collaboration segments are still in transition, the overall AI pipeline continues to strengthen.

📅 Earnings Watch

With financials strengthening and Washington nearing a resolution, markets are entering a pivotal stretch before year-end.

Which stocks are you watching as momentum shifts across sectors?

Disclaimer

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.