Gotrade Daily: Fed Week Begins as Netflix Makes a Big Move

Traders focus on the Fed and Netflix’s WBD deal.

US stocks closed higher on Friday, with the S&P 500 inching closer to a fresh record as traders positioned ahead of next week’s Federal Reserve meeting. Sentiment improved after the latest PCE inflation reading showed cooling price pressures, reinforcing expectations that the Fed is ready to cut rates. Meanwhile, news that Netflix (NFLX) will acquire Warner Bros. Discovery’s studios and HBO drew heavy attention across the market.

The Fed remains the central driver. Traders are pricing in 87 percent odds of a rate cut next Wednesday, supported by Friday’s data showing core PCE rising 2.8 percent year over year, slightly softer than prior months. Confidence also improved as consumer sentiment logged its first rise in five months, adding to the view that inflation is easing without a sharp downturn.

Elsewhere, the labor market delivered mixed signals. Corporate layoffs jumped for November, but weekly jobless claims fell to the lowest level since 2022, suggesting cooling rather than weakening. The Netflix acquisition added another catalyst to the session, while large caps traded steadily into the close ahead of a packed week of data and the final Fed decision of 2025.

📊 Market Wrap Dec 8 2025

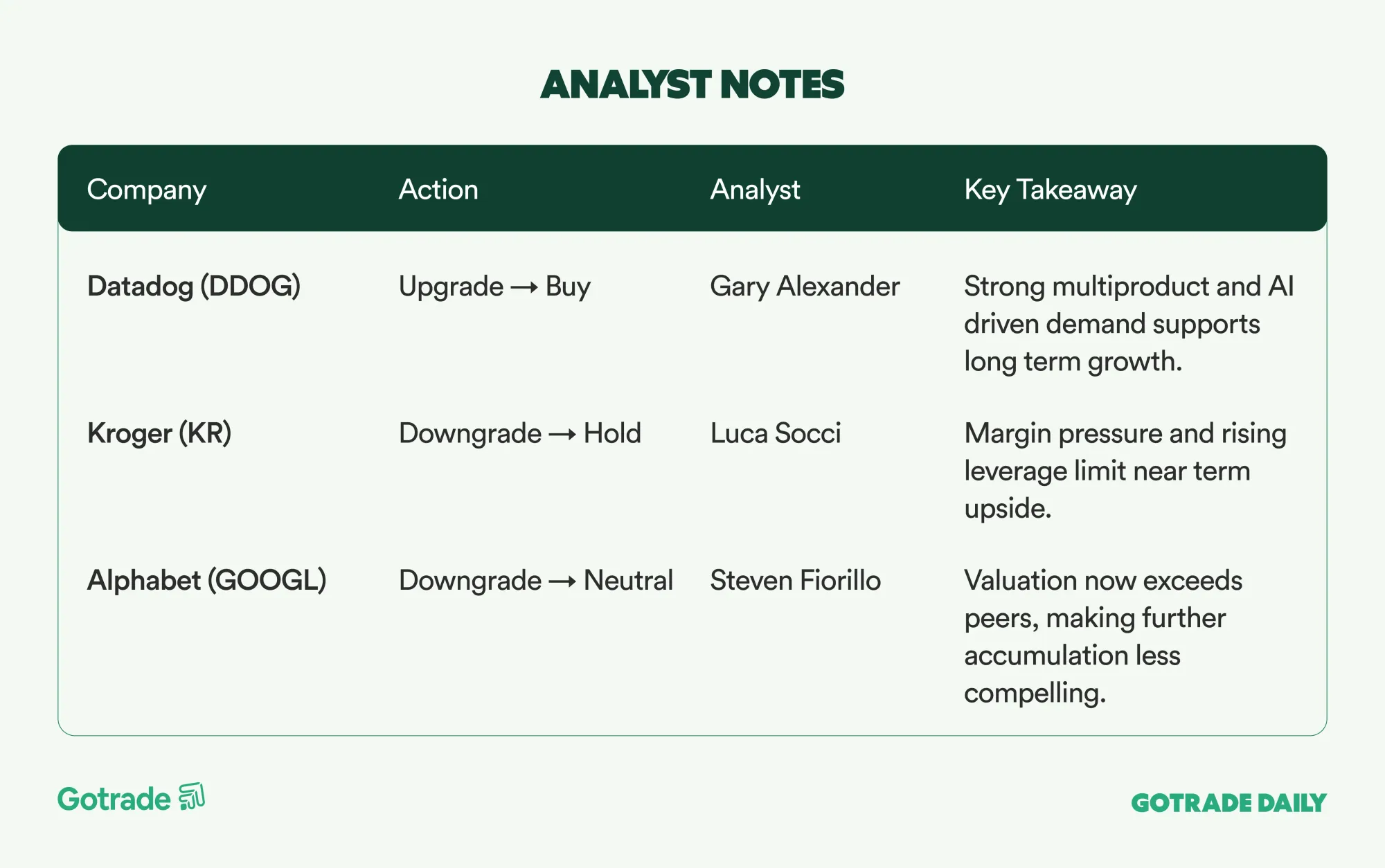

🧠 Analyst Notes

💬 Market Highlights

Meta postpones next generation mixed reality headset to 2027

Meta (META) has delayed the launch of its next mixed reality headset, Phoenix, from 2026 to the first half of 2027. The company is extending development timelines while evaluating internal priorities and planning up to 30 percent budget reductions in its Metaverse division, which has accumulated 73 billion dollars in losses since inception. The delay reflects Meta’s push to refine product strategy amid shifting investment focus.

US investment in xLight introduces long term risk to ASML

The US government has invested 150 million dollars in xLight, a developer of free electron laser lithography that could potentially deliver productivity up to four times higher than ASML’s (ASML) EUV systems. If the technology proves commercially viable, it could reduce future EUV demand and challenge ASML’s growth trajectory. While commercialization remains unlikely before the end of the decade, government backing elevates xLight as a structural risk factor for ASML over the long term.

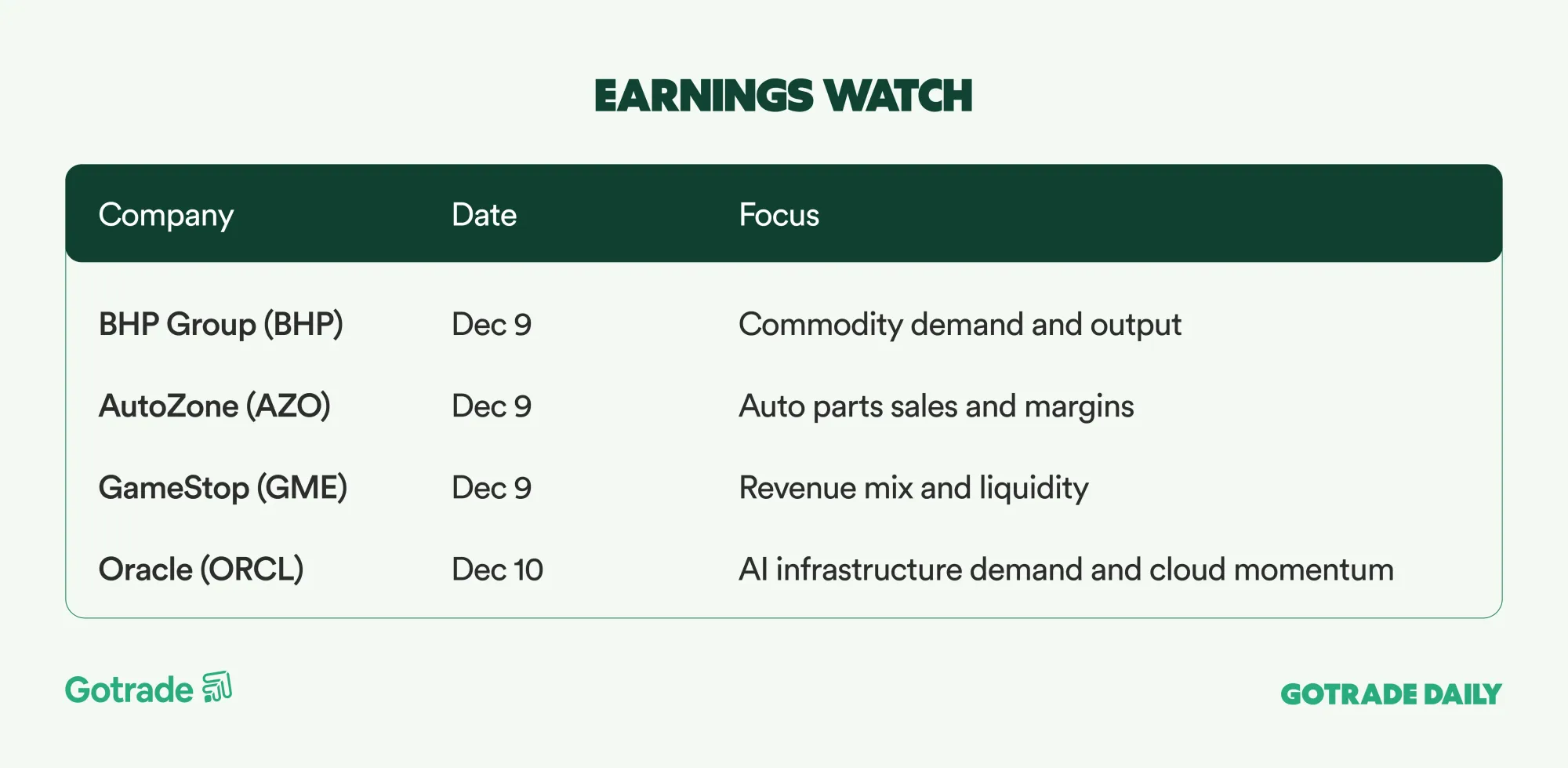

GameStop draws attention ahead of earnings as cash pile surges

GameStop (GME) enters earnings season with heightened attention on its 8.7 billion dollar cash position and more than 500 million dollars in Bitcoin holdings. The company’s market value now sits only slightly above total cash, fueling speculation about whether management may pivot to a holding company structure, pursue acquisitions, or double down on collectibles. Analysts remain divided, though some see potential recovery after a challenging year.

📅 Earnings Watch

Markets enter the week with rate expectations, bond yields, and tech news at the center of positioning. Traders will be watching how the Fed decision and major corporate updates shape sentiment into mid December.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.