Gotrade Daily: Chip Stocks Rise as Fed Week Begins

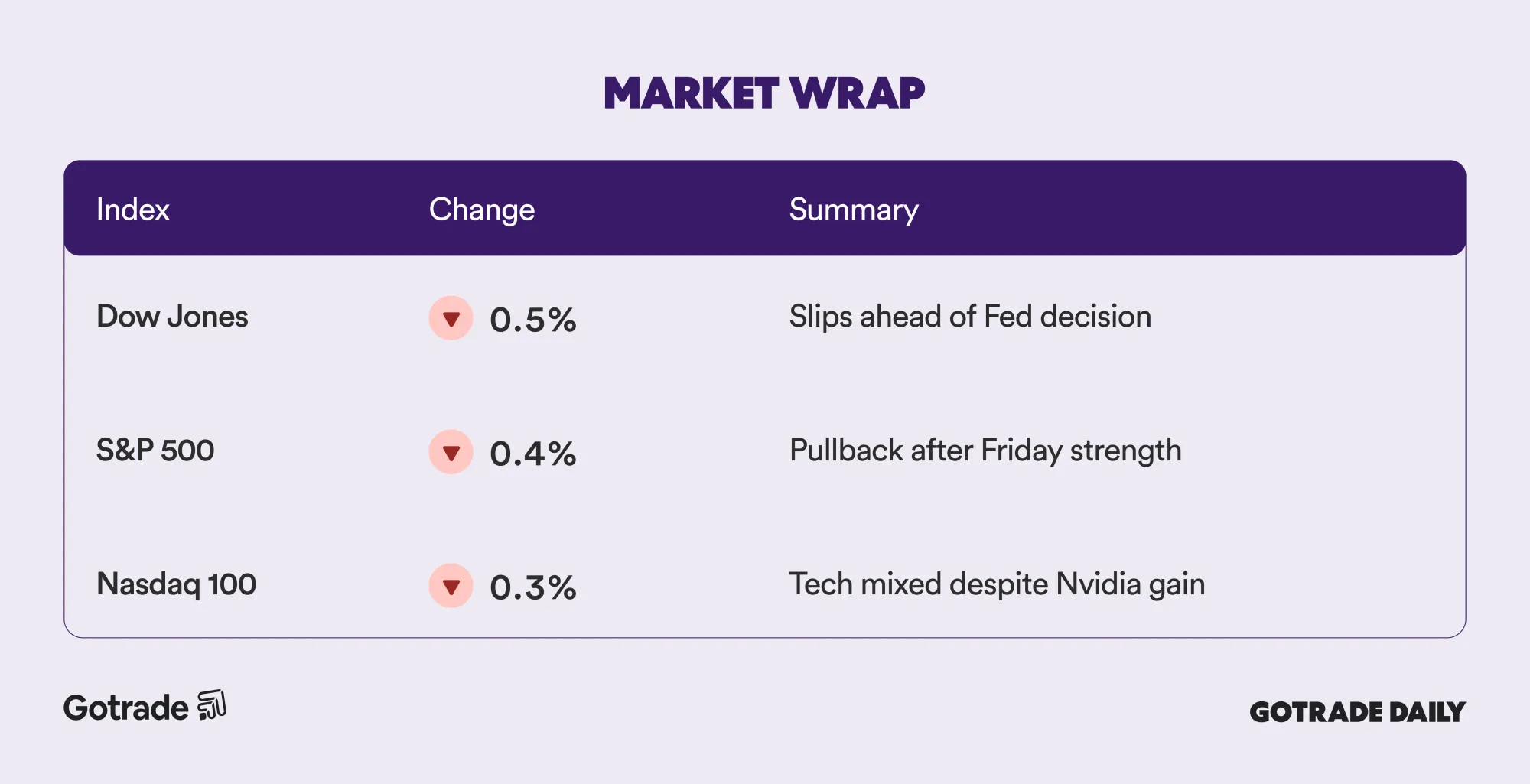

Indexes dip as traders position for the Fed meeting.

US stocks fell on Monday as traders prepared for the Federal Reserve’s final policy meeting of the year and monitored new developments in the semiconductor sector. Nvidia (NVDA), AMD (AMD), and Intel (INTC) outperformed after President Trump approved the sale of Nvidia’s H200 chips to China under controlled conditions.

The broader market traded cautiously as expectations for a rate cut remained elevated. Traders now see an 88 percent probability of a move lower on Wednesday, supported by last week’s mild PCE inflation reading and continued confidence that the Fed is ready to deliver its third cut of 2025.

For traders, the setup reflects two key drivers: policy risk around Wednesday’s decision and shifts in tech leadership as geopolitical headlines influence semiconductor sentiment. Corporate updates also added volatility, with Warner Bros. Discovery jumping on a new takeover bid and Netflix (NFLX) slipping more than 3 percent.

📊 Market Wrap Dec 9 2025

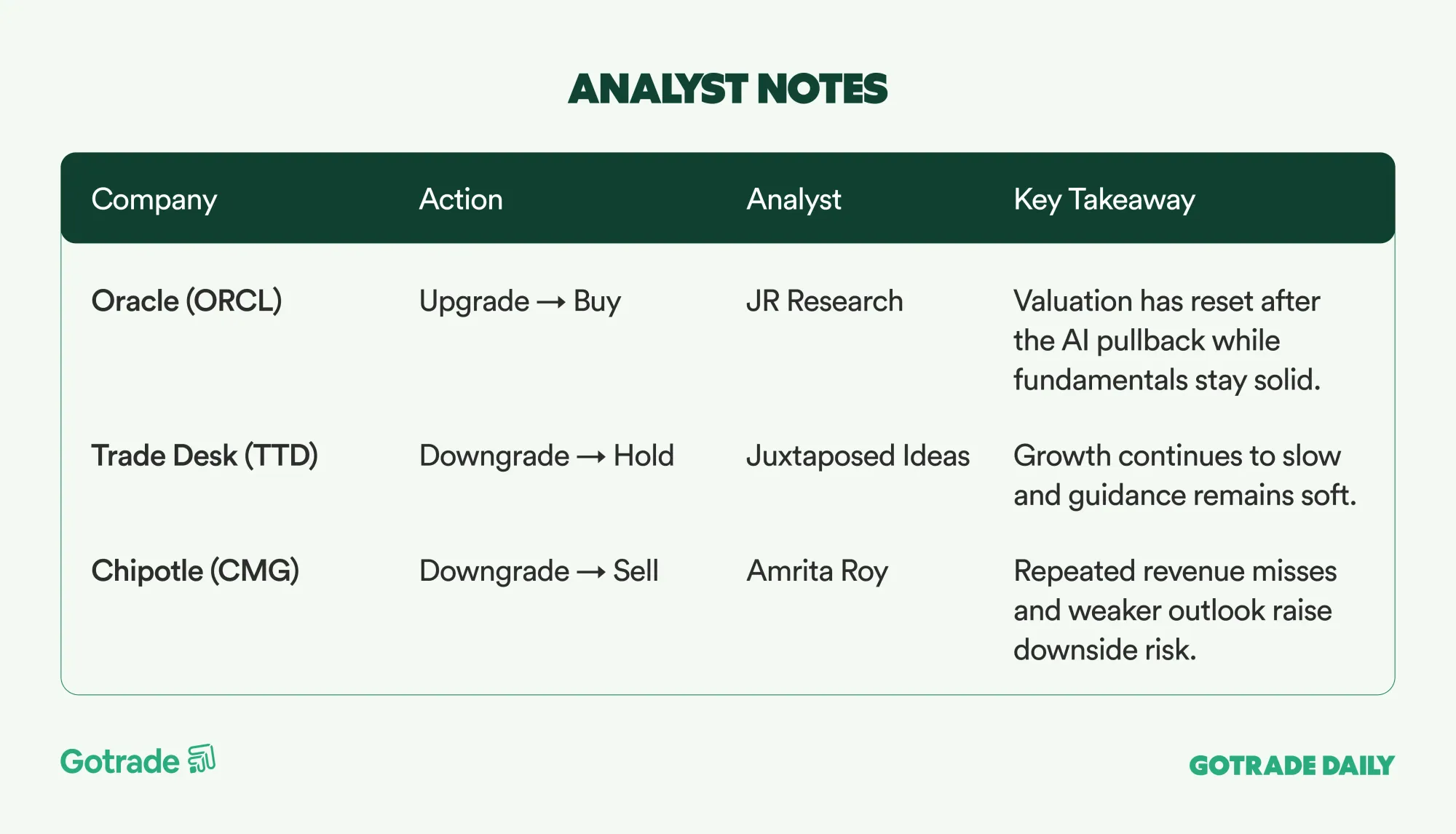

🧠 Analyst Notes

💬 Market Highlights

⚡ PJM selects NextEra and Exelon for 220 mile transmission project

PJM Interconnection has chosen NextEra Energy (NEE) and Exelon to build a 220 mile, 765 kV transmission line spanning Pennsylvania and parts of West Virginia. The project is designed as a two way “electricity superhighway” capable of moving roughly 7 GW of power, offering higher efficiency and capacity compared to existing 500 kV networks. PJM’s board is expected to issue a final decision early next year.

📉 Salesforce slips after six day rally despite strong Q3 results

Salesforce (CRM) ended lower after a six session rally that lifted shares 13 percent. The pullback comes even as the company reported solid Q3 results and raised its FY26 outlook. Adoption of Agentforce AI continues to grow, but some analysts note that valuation now reflects much of the optimism and that momentum reacceleration still needs to be confirmed.

📡 AT&T reaffirms FY25 targets and outlines major fiber expansion plan

AT&T (T) reaffirmed its 2025 performance outlook and long term strategy ahead of remarks at the UBS Global Media and Communications Conference. The company plans a large scale fiber expansion supported by its acquisition of Lumen’s mass market fiber business and mid band spectrum from EchoStar, aiming to reach 60 million locations by 2030. AT&T also targets up to 20 billion dollars in buybacks from 2025 to 2027 while maintaining leverage around 2.5x EBITDA.

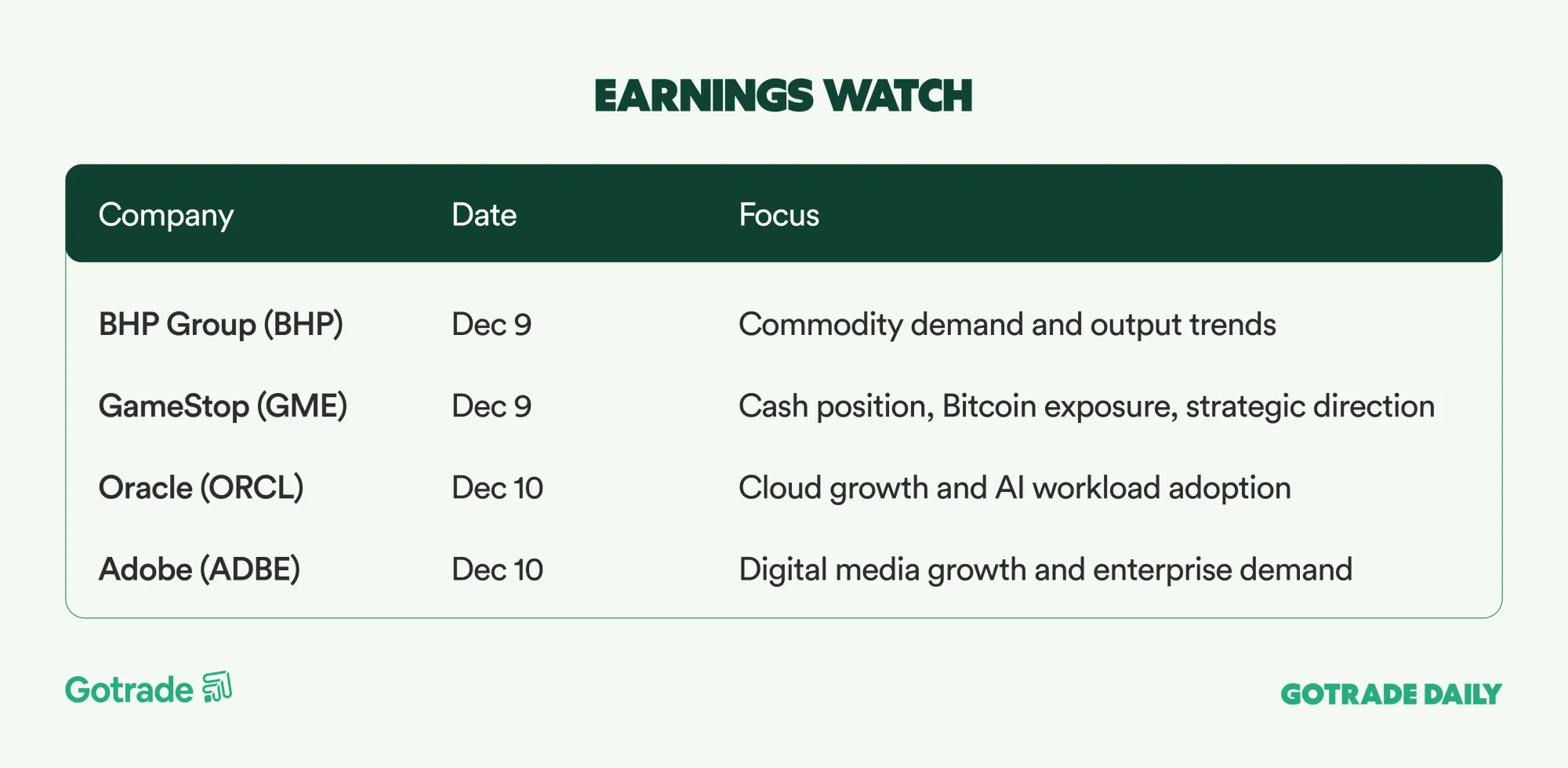

📅 Earnings Watch

Markets open the week with a more cautious tone as traders position ahead of Wednesday’s Fed decision. Attention now turns to how policy and corporate news shape sentiment into the final stretch of the year.

Which stocks are you watching today?

Disclaimer:

Gotrade is the trading name of Gotrade Securities Inc., registered with and supervised by the Labuan Financial Services Authority (LFSA). This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing.