Analisis Saham DoorDash (DASH) Hari Ini

Ditulis oleh Aries Yuangga

Ringkasan

DoorDash (NASDAQ: DASH) baru saja masuk fase koreksi, turun ~30% dari puncak, padahal:

Fundamental = Semakin Kuat

- GOV (Gross Order Value) tumbuh 25% YoY, accelerating second quarter in a row.

- Margin & monetisasi makin tinggi → net revenue margin naik ke 13.8%.

- EBITDA tumbuh 41% YoY → FCF TTM tembus $1.99B.

- Deliveroo acquisition → menambah skala ~10–11%, menjadikan DASH platform delivery terbesar di dunia.

Sentimen = Salah Fokus

- Restaurant chains crash (CMG, CAVA), tapi DASH tidak mengalami pelemahan demand.

- Konsumen 25–35 tahun melemah? Ya → tetapi kebiasaan pelayanan on-demand tidak hilang setelah COVID.

- Partnership (JPM, Lyft, promos, DashPass) menjaga GOV tetap kuat.

Valuasi turun → peluang besar

DASH kini diperdagangkan di EV/FY26E EBITDA ~20.6x → setara UBER, padahal DASH lebih cepat tumbuh dan lebih profitable di unit economics.

📌 Rating: STRONG BUY

📌 Dip ini adalah koreksi terbaik sejak 2023 untuk akumulasi jangka panjang.

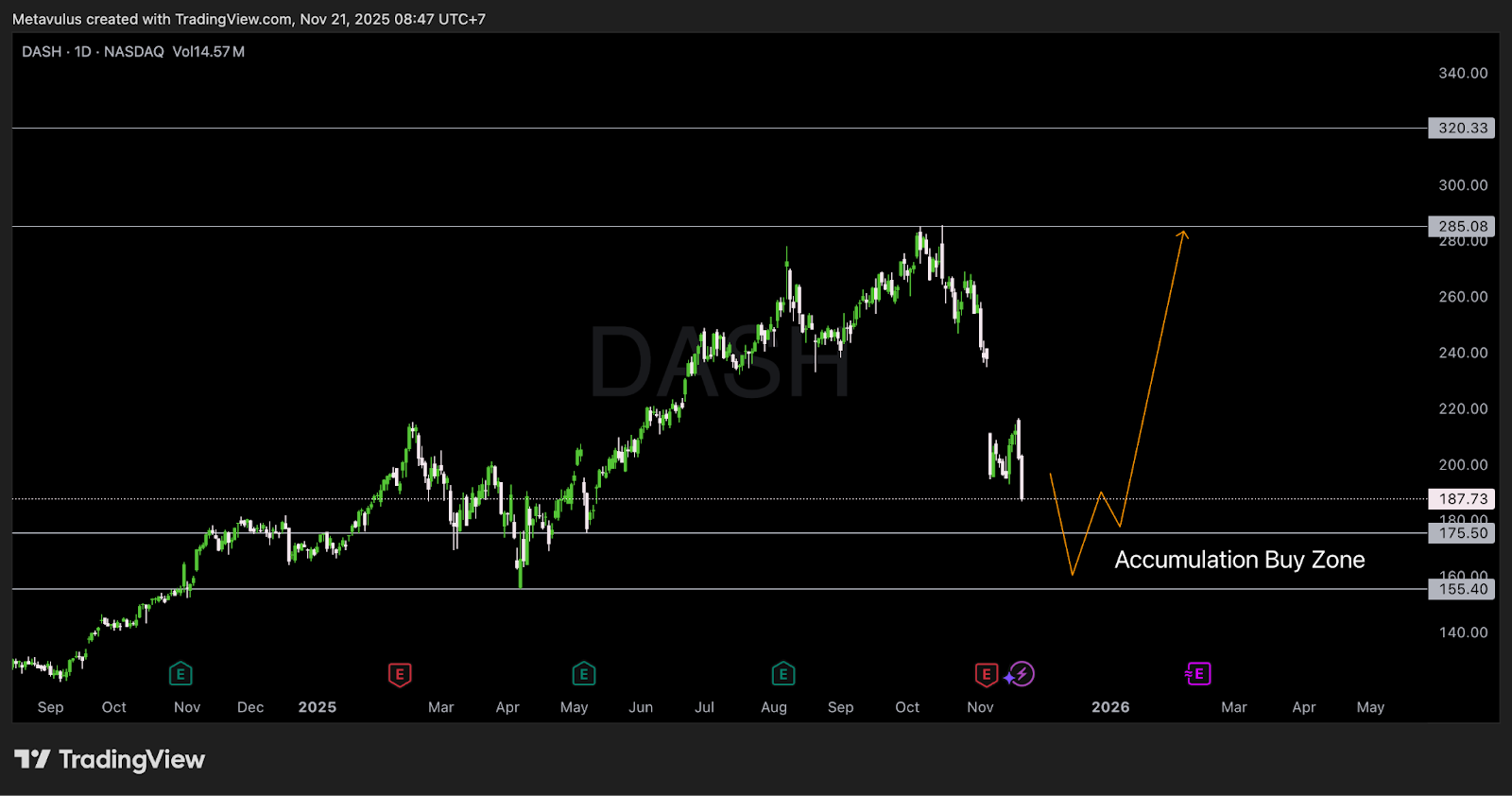

Technical Analysis

Current Price: ~US$187.73

Key Levels

Resistance

- 285.08 → target rebound utama (zona supply)

- 320.33 → major resistance & long-term target

Accumulation Buy Zone

Sama seperti yang kamu plot:

- 175.50 → top of zone

- 155.40 → bottom of zone (ideal flush level)

Ini adalah area:

- Support historis April–May

- Struktur demand kuat

- Potensi swing failure pattern (SFP) jika terjadi washout

Invalidation

- Weekly close < 152 = struktur bullish patah → wait new base.

Trading Setup

DCA Plan (Long-Term Investors)

| Zone | Allocation |

|---|---|

| 187–175 | 40% |

| 175–160 | 40% |

| 160–155 | 20% (opportunity hold) |

Average cost (full-fill): ≈165–172

Swing Trading Setup

- Entry 1: 175–178

- Entry 2: 160–165

- Stop: 150 weekly close

- TP1: 230

- TP2: 285

- Stretch Target: 320+

Why the Thesis Works (Pillars)

DoorDash is NOT Restaurants, It’s Delivery Infrastructure

Restaurant comps crash (CMG, CAVA) ≠ Delivery demand crash.

DASH growth:

- Q1: 20%

- Q2: 23%

- Q3: 25% (accelerating)

Restaurant comps:

- Chipotle: 0.3%

- CAVA: slowdown brutal

- Sector: dark macro

🚀 DASH immune karena:

- Konsumen tetap beli makanan → delivery menang dari dine-in

- Much stronger promo ecosystem

- Credit card partnerships (JPM → DashPass benefit)

Deliveroo Acquisition = Supercharger for Scale

- +$2.7B GOV dalam satu kuartal

- DASH kini platform food delivery #1 global

- Integration → significant EBITDA uplift melalui:

- overhead cuts

- unified Europe ops

- Wolt + DoorDash + Deliveroo synergy

CEO Tony Xu confirm:

👉 Deliveroo better than expected

👉 Huge room to lift unit economics

Free Cash Flow Machine

- TTM FCF: $1.99B

- EBITDA margin: 21.9% of revenue (expanding)

- 2026 EBITDA est $3.93B

Investment cycle 2026:

- “Hundreds of millions” → small vs $2B FCF per year

- Dan return-nya cepat (DoorDash for Business langsung boost revenue)

This company is simply too profitable to ignore.

Valuation Reset = Pure Opportunity

At ~US$202 → market cap $87.2BEV ≈ $81.0B

2026 Estimates:

- Revenue: $17.8B

- EBITDA: $3.93B

→ EV/EBITDA ≈ 20.6x

Setara dengan UBER padahal DASH:

- tumbuh lebih cepat

- memimpin delivery global

- margin semakin lebar

Valuation gap = mispricing.

Valuation & Scenarios

Base Case (12–18 months)

- GOV growth bertahan 20–25%

- Deliveroo integration memberi margin uplift

- Market re-rate delivery sector

🎯 Price Target: 250–285

Bull Case (2026–2027)

- DASH for Business → major new revenue engine

- Synergy Deliveroo + Wolt lebih besar dari perhitungan

- Multi-country scale advantage

🎯 Price Target: 310–330

Bear Case

- Konsumen makin melemah

- Promos inflate cost

- Regulation on delivery fee

📉 Downside floor: 155–160 = accumulation zone kamu.

Risks

- Konsumen melemah → lower frequency

- Regulation cap fee per delivery

- Heavy investment cycle compress margin short term

- Deliveroo integration risk (execution risk)

Tidak ada yang mematikan thesis, hanya memperlambat compounded growth.

Conclusion

DoorDash sedang mengalami disconnect antara fundamental kuat vs sentimen lemah.

Sementara restaurant stocks crash, DASH justru:

- GOV accelerating

- Monetisasi makin tinggi

- EBITDA breakouts

- FCF besar

- Deliveroo boost scale 10–11%

Dan sekarang sahamnya turun 30%, tanpa adanya penurunan bisnis.

Ini textbook BUY THE DIP untuk compounder high-growth high-FCF seperti DASH.

Verdict: STRONG BUY.

Buy Zone: 175.50 – 155.40

Target: 285 → 3203–5 year potential: Multi-bagger

Disclaimer: PT Valbury Asia Futures Pialang berjangka yang berizin dan diawasi OJK untuk produk derivatif keuangan dengan aset yang mendasari berupa Efek.